ROI (Return on Investment) is a crucial measure when calculating distribution business investment. Yet, when it comes to inventory, a more specified ROI formula is necessary to ensure you’re actually making money. For instance, most distributors (and their salespeople) look at how much money they make on a sale. While this is important, there’s much more to consider. Let’s take a deeper look.

A2Z Wholesale’s purchasing agent buys 10 cases of lag bolts at a great price: $100/case. From this, the sales department sells three cases at $225/case. Did they make a profit? Sure. $100 x 3 = $300 cost, and they sold those three cases for $675. So, mathematically they made $375.

But do they have any money? The answer is no. Why? Though they did make a profit, they had to pay their supplier $1000 but they only took in $675. That means they’re still short $325. In other words, A2Z Wholesale made money but ended up having none.

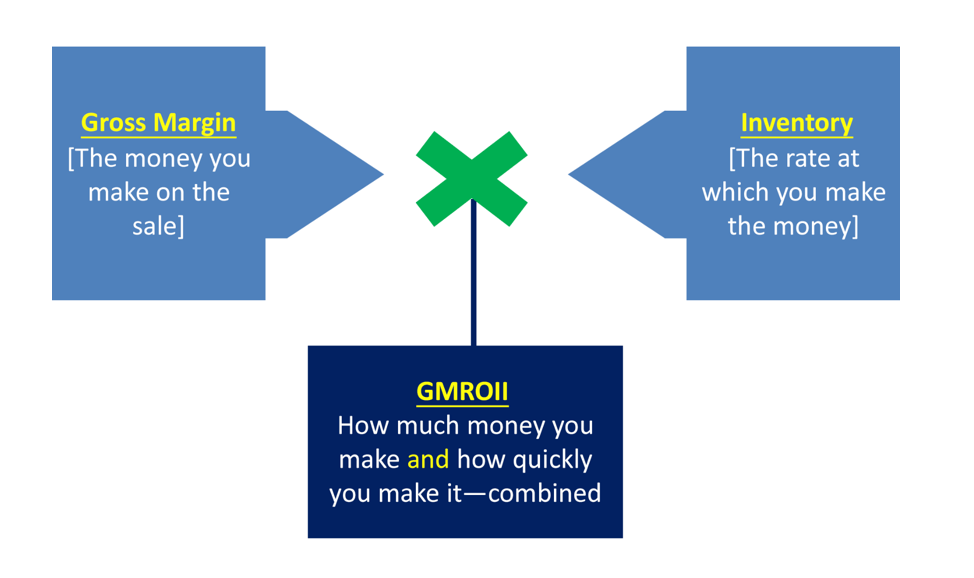

This example perfectly demonstrates the value of using GMROII (Gross Margin Return on Inventory Investment). Instead of only looking at Gross profit per sale, companies should be looking at three numbers versus just one:

- Gross profit dollars

- Average inventory during the year

- Turns–how often the item sells in a year

By calculating GMROII, you will know how much money you are making or losing on all inventory because you look at the money from the items that sold plus the “loss” from the items that didn’t sell.

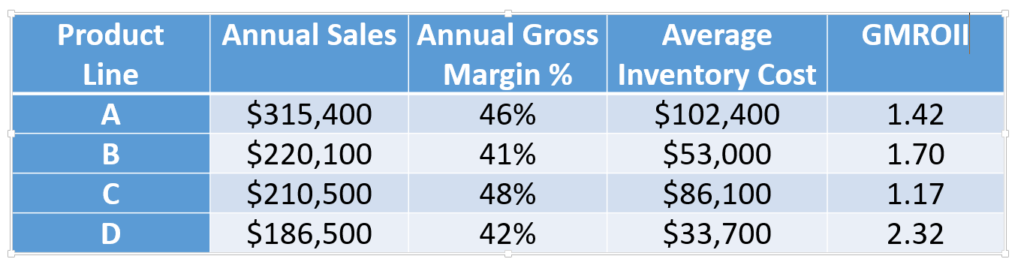

A GMROII number greater than 1 means you’re making and keeping money while GMROII less than one is cause for concern. Now that you understand GMROII, take a look at the following chart. Using the sample information, can you determine which product line your salespeople want to sell?

Interested in taking a deeper dive into GMROII or want to ask additional questions? Contact us today.